Late retirement: More than 25% of seniors still work in some US cities

Canva

Late retirement: More than 25% of seniors still work in some US cities

An older couple sit together on a couch going over financial paperwork.

While age 65 was considered full retirement age for half a century, employment is becoming more and more common for people in their mid-60s and older. Roughly one in five Americans 65 and older remained in the labor force. By 2031, the Bureau of Labor Statistics expects almost a third of all people between ages 65 and 74 will still be working or looking for work. In 2001, that number was less than 20%.

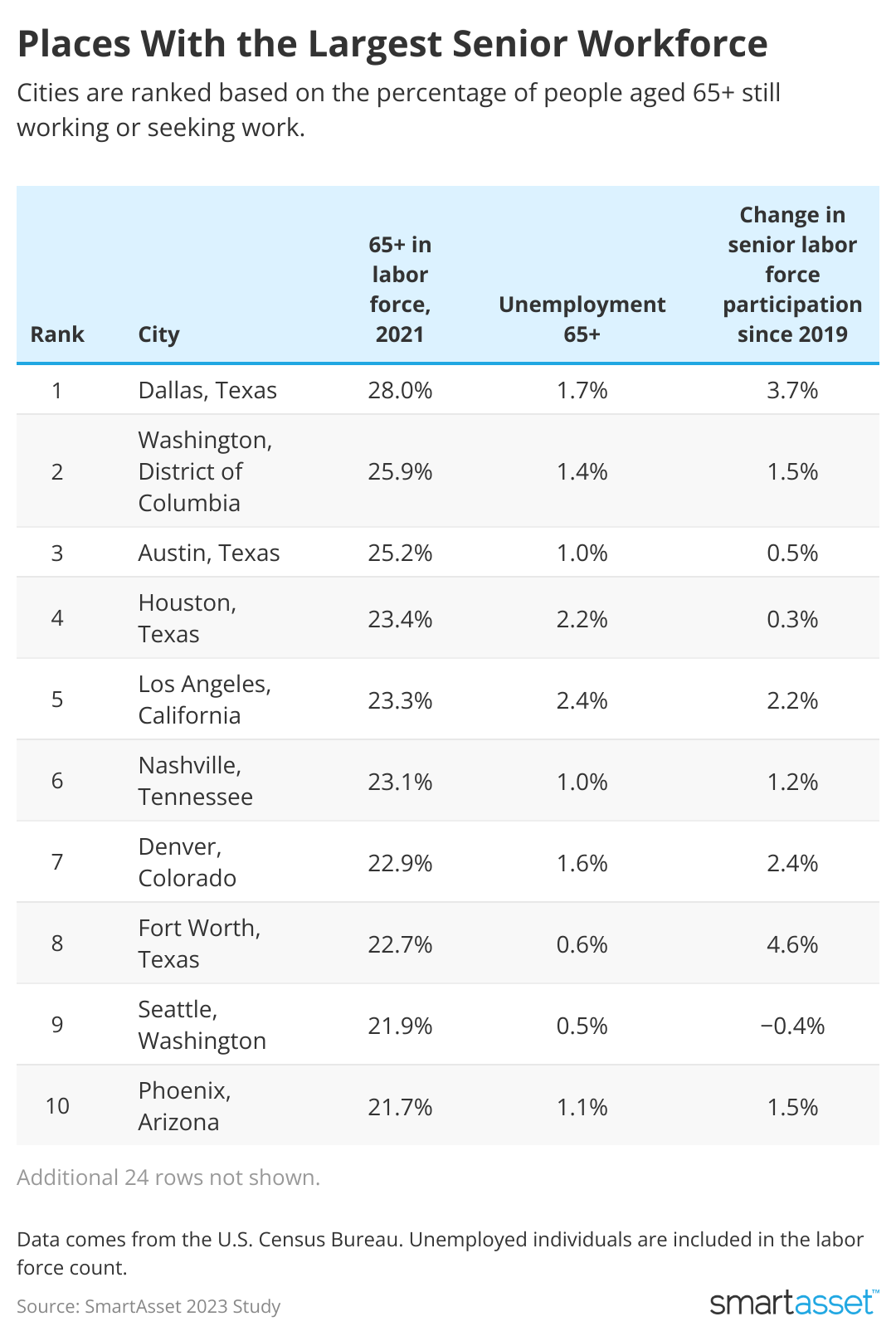

As employment becomes a common component of retirement planning, SmartAsset set out to identify the places where seniors are working most. This study examines the most recent labor force data for 34 of the largest cities in the country. We also compared those figures with similar data from two years earlier to get a sense of how things have changed.

Key findings

- Dallas has the most seniors in the labor force. Twenty-eight percent of people age 65 and older in Dallas are still in the labor force – more than 26% of whom are actively working. That’s more than any other city tracked in the study.

- It’s most difficult for seniors to find work in LA, Boston and Las Vegas. These three cities are tied with the highest unemployment rates for people age 65 and older seeking work: 2.4%. Jacksonville, Florida and Oklahoma City, on the other hand, both have the lowest senior unemployment rates (0.4%).

- Seniors still working in these cities make over $130k on average. People age 65 and older who continue working in San Francisco earn over $193,000 per year, more than any other city. San Jose ($175,675), Seattle ($156,330) and Washington D.C. ($144,947) all have the next highest average earnings for senior workers.

- These large cities have the lowest percentage of seniors working or looking for work. Sacramento, California, has the lowest percentage of seniors in the labor force (13.1%), followed by Detroit (15.5%), Mesa, AZ (16%) and Las Vegas (16%).

- Fort Worth, TX had the largest two-year increase in 65+ labor force participation. Between 2019 and 2021, Fort Worth saw a 4.6% increase in the number of seniors who were either working or actively seeking employment. That’s nearly 1 percentage point higher than Dallas, which had the second-largest two-year increase (3.7%).

- The working-senior population shrank in 14 cities. Between 2019 and 2021, Oklahoma City saw the largest decline (-4.3%) in its percentage of seniors working or still looking for work. Tucson, AZ and Sacramento, CA recorded the second- and third-largest drops (-3.9% and -2.7%, respectively) during that same time period.

![]()

SmartAsset

A closer look at the top 10 cities for senior employment

A chart showing the places with the largest senior workforce

1. Dallas, TX

No city has a higher percentage of people 65 and older who are still in the labor force than Dallas (28%). Between 2019 and 2021, the city saw a 3.7% increase in the number of seniors working or actively looking for work, second-most across the study. Meanwhile, senior unemployment rose slightly (0.4%) during that period, reaching 1.7% in 2021.

2. Washington D.C.

If you’re 65 or older in Washington D.C., there’s nearly a 26% chance you’re still in the work force. The nation’s capital is tied with Phoenix for the eighth-largest increase (1.5%) in the working-senior population from 2019 to 2021. Workers ages 65 and older earn an average salary of nearly $145,000 per year, fourth-highest.

3. Austin, TX

More than a quarter of all people 65 and older in Austin (25.2%) were still in the labor force in 2021, a 0.5% increase from two years earlier. Meanwhile, the seniors in the Texas state capital who continue working earn an average salary of $114,742 – ninth-highest across studywide. Earnings increased $9,514 on average between 2019 and 2021.

4. Houston, TX

In Houston, 23.4% of the 65+ population is still in the labor force – a modest 0.3% increase from 2019. However, unemployment among people 65 and older increased 1.5%, reaching 2.2% in 2021 (fourth-highest).

5. Los Angeles, CA

The number of Los Angelinos age 65 and older in the work force climbed to 23.3% in 2021, a 2.2% increase from two years earlier. Working seniors in L.A. earn over $106,000 per year – 13th-highest across the study.

6. Nashville, TN

The Nashville-Davidson area is home to the sixth-highest labor force participation rate (23.1%) for people 65 and older. The number of seniors still in the work force in greater Nashville increased 1.2% between 2019 and 2021 – more than it did in 22 other cities.

7. Denver, CO

In the Mile High City, 22.9% of the population over 65 was still in the work force in 2021 – a 2.4 percentage point increase from two years earlier. Denver seniors who continue to work earn $116,545 per year on average.

8. Fort Worth, TX

Fort Worth has the eighth-highest percentage (22.7%) of seniors who are still working or actively seeking employment. No city had a larger increase between 2019 and 2021 than Fort Worth, which saw the labor force participation rate for seniors rise 4.6%. Senior unemployment (0.6%) remained relatively the same during that time, increasing a meager 0.1%.

9. Seattle, WA

Seattle saw a slight dip (-0.4%) in labor force participation among people 65 and older between 2019 and 2021. However, 21.4% of seniors in the Emerald City are still working or seeking work – ninth-highest studywide. The city also had the second-largest increase in average earnings for people 65 and older. Working seniors earned $12,264 more in 2021 than they did two years earlier.

T-10. Memphis, TN

In Memphis, 21.7% of people 65 and older are still working or looking for work – a 0.5% increase since 2019. While Memphis has low senior unemployment (0.7%), the average earnings for people 65 and older are just $69,902 per year, which is fourth-lowest.

T-10. Phoenix, AZ

Like Memphis, Phoenix has a senior labor force participation rate of 21.7%. The city saw a 1.5% rise in seniors who continue to work or look for work between 2019 and 2021 – tied for the eighth-highest increase over those two years. Average earnings for senior workers in Phoenix also rose significantly, increasing $9,408 to $93,659 in 2021.

Data and methodology

This study examined 34 of the largest U.S. cities for which data was available. Cities were ranked based on the proportion of people aged 65+ still in the labor force, which includes both seniors who are employed as well as those unemployed but still looking for work. Labor force participation rates from 2021 were also compared to those of 2019. Data comes from the U.S. Census Bureau’s 2021 and 2019 1-Year ACS Survey, S0103.

Retirement planning tips

- Maximize Social Security. If you expect to work part-time in retirement, you may be in a position to delay Social Security until age 70 to maximize your eventual benefits. Those benefits will increase up to 8% for every year you delay Social Security after reaching full retirement age (FRA). By age 70, your benefits could be worth up to 132% more than they would have had you claimed at FRA. However, delaying Social Security may not be the best strategy for people with shorter life expectancies.

- Focus on income. Generating enough income in retirement is vital. The experts at T. Rowe Price says you should start by aiming to replace 75% of your pre-retirement income. Your replacement rate may be higher or lower depending on your income, savings rate throughout your career and other factors. The more income sources you have in retirement – from Social Security and portfolio withdrawals to pensions and annuities – the better.

- Work with a finance professional. Whether you plan to sit on a beach or continue to work part-time, a financial advisor can help you prepare for retirement. Finding a financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three vetted financial advisors who serve your area, and you can have a free introductory call with your advisor matches to decide which one you feel is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

This story was produced by SmartAsset and reviewed and distributed by Stacker Media.