Which large US cities have grown the most since 2016?

Canva

Which large US cities have grown the most since 2016?

Downtown Provo, Utah.

America is both on the move and not—depending on which set of data one is looking at. For example, Americans are moving less often than they have in prior decades, when one looks at U.S. Census data tracking interstate migration. On the other hand, Americans are swelling the size of some cities, as new residents move in from bigger metros as well as rural areas.

In this analysis, Experian looked at large cities that are growing faster than average—the cities that added 100,000 or more new residents over the past six years and grew at least 5%, according to Census data. We then compare some of the credit characteristics of these cities attracting new residents to the overall population. For more information on city population and credit trends, view Experian’s accompanying analysis of mid-sized U.S. cities.

![]()

Experian

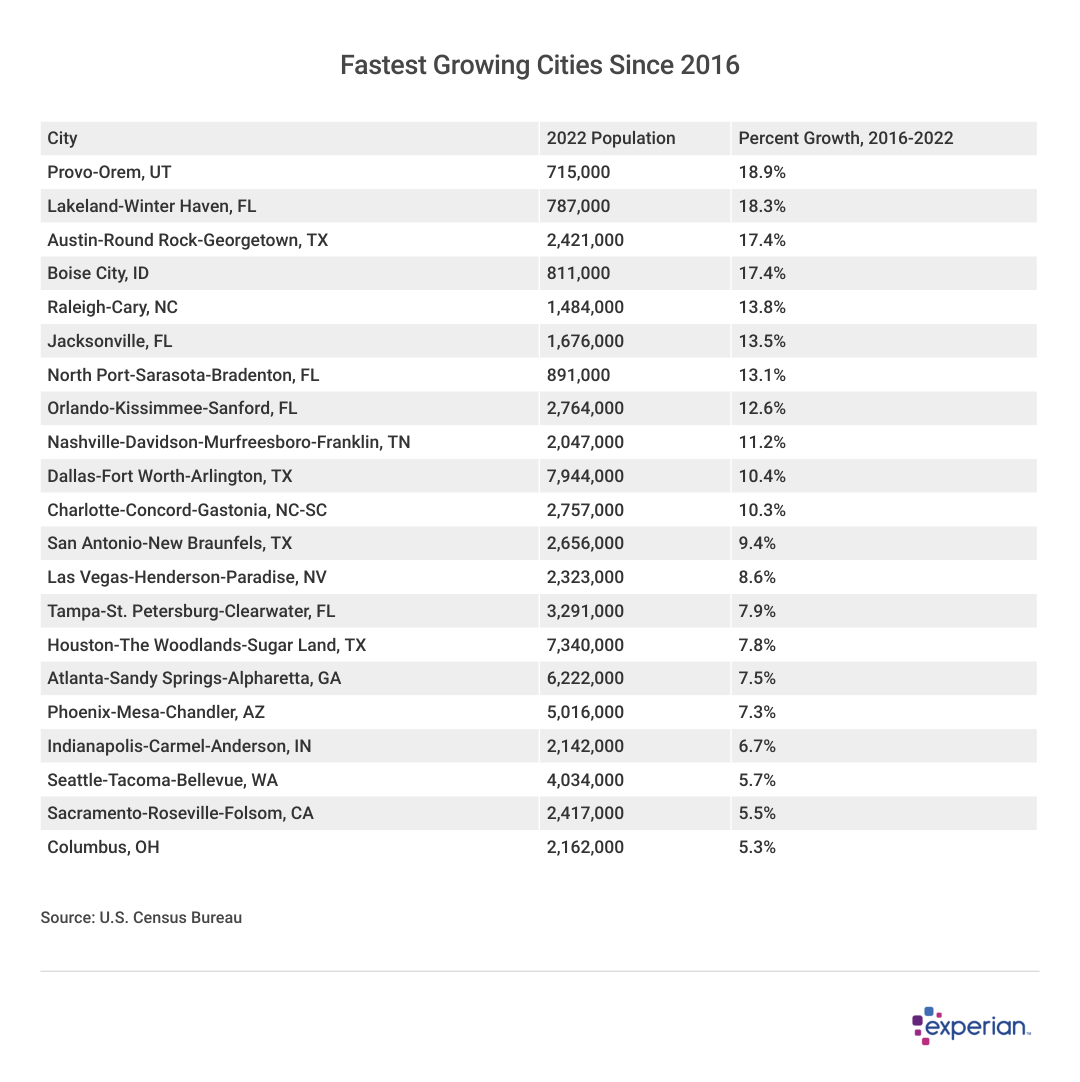

21 large cities added 100,000 or more residents since 2016

A table showing the 21 fastest-growing large U.S. cities.

Adding a full football stadium’s worth of people to a city will inevitably change the local economy, and these “Boom Cities” are most likely to benefit from the economic growth that comes from a growing population. The presence of more workers, in turn, induces more economic activity and new home construction, major drivers of any local economy. This virtuous economic cycle attracts even more residents to the city and surrounding area in the forthcoming years.

Below are the 21 U.S. cities that added 100,000 or more people to their local populations, as measured by metropolitan statistical areas, and grew by 5% or more since 2016. The list contains some familiar names and perhaps a few surprises. The usual suspects that have been growing for years include Las Vegas, Phoenix, and the largest Texas cities of Dallas, Houston, San Antonio and Austin. Meanwhile, other cities may be more surprising for some, such as Lakeland, Florida, and Columbus, Ohio, each of which added more than 100,000 newcomers in recent years.

- Out of all the Boom Cities, “little big cities” are growing the most. Most of the fastest-growing cities—those that grew by 15% or more since 2016—were also the smallest of the big cities included here. Provo, Utah; Lakeland, Florida; and Boise, Idaho still have populations of fewer than 1 million residents in their respective metropolitan areas, but that won’t last long at their current growth rates. Since 2016, Provo grew by 18.9% to 715,000, Lakeland by 18.3% to 787,000, and Boise by 17.4% to 811,000. Only Austin, Texas, grew that quickly while already having more than 2 million residents in 2016.

- Go South by Southwest, young person. No large cities in the Northeast grew at a 5% or greater rate since 2016, according to Census data, and the only two Midwestern cities on the list, Columbus, Ohio, and Indianapolis, border Southern states.

- Follow the new home construction. There’s a shortage of residential housing throughout the U.S., including in the 21 U.S. Boom Cities. But at least new residential construction is high in most of the cities. Of the 21 fastest-growing cities, 13 are also among the metros building the most residential units in 2022, according to census data.

Experian

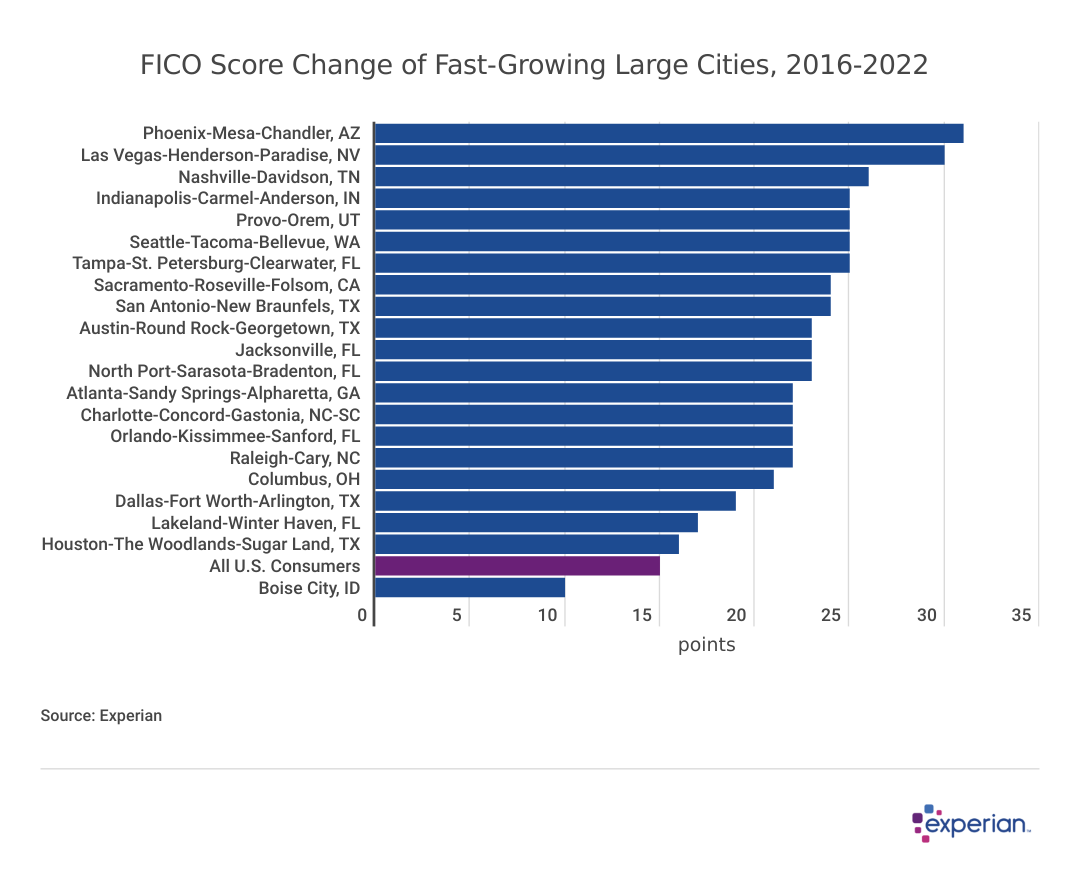

Boom cities, boom credit scores

A table showing how large US cities compare by average FICO score change since 2016.

Boom Cities not only saw their populations increase; their respective FICO Scores increased noticeably as well. Since 2016, the fastest-growing large cities have increased their average FICO Scores by an average of 23 points. That’s greater than the nationwide average over that same period, where scores increased by an average of 15 points, from 699 in 2016 to 714 in September 2022.

In the cases of Austin, Texas; Columbus, Ohio; and Nashville, Tennessee; the score improvements were so great that in just a few years, these cities changed from having below-average FICO Scores to having scores better than the current national average of 714.

Experian

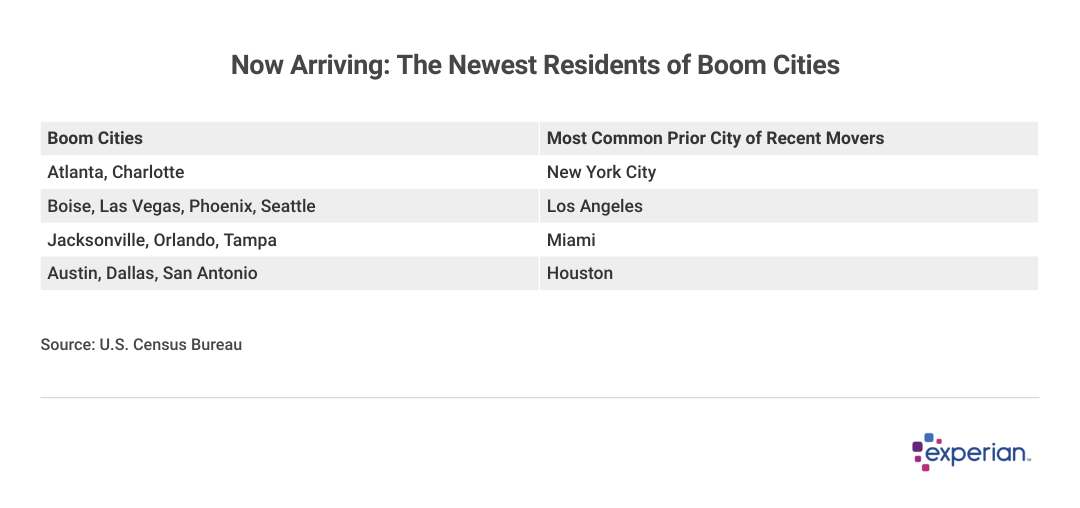

Where are all these new people coming from?

A table showing that new residents of boom cities are coming most often from New York City, L.A., Miami, and Houston.

When we look at the most common source of new residents for the fastest-growing large cities, we see two broad trends.

- Three places feed much of the migration. New York City, Los Angeles and Miami are where many new residents of Boom Cities are coming from. Each of these U.S. cities supplied growth to one or more Boom City. New York City residents moved to Atlanta and Charlotte, North Carolina; and former Los Angeles residents migrated to Boise, Idaho; Phoenix; and Seattle. Former Miami residents supplied growth to four Boom Cities—all of them in Florida.

- Intra-state moving is also an important pipeline. Speaking of Miami, one important difference between former Miami residents and ex-New Yorkers and Angelinos is that Miami residents stayed in-state when finding new places to live. Although new retirees are a constant source of new Floridians, residents leaving Miami also grow other metros in the Sunshine State. The Florida cities of Jacksonville, Lakeland, Orlando and Tampa all received many new residents from Miami. This phenomenon can also be observed in other Boom Cities: Many new Provo, Utah, residents came from Salt Lake City, for example. And Texans even swap one city for another: Houston was the source of most new Dallas residents, and most new Houston residents came from Dallas.

Migration trend will likely persist into the decade

The faster-growing cities in the 2020s have been—and will likely continue to be—Southern and Western U.S. cities, based on migration and population data on metros from the Census Bureau. Economic conditions in these metros since 2016 have encouraged residential construction here more than elsewhere, which in turn attracts more new residents, especially from other cities with expensive housing markets and little if any new housing supply.

There are also longer-term headwinds facing consumers that may continue to impede migration, especially for younger generations. One is the often-referenced housing shortage: The deficit is so vast, estimates of how many new homes are needed range from 1.7 million to nearly 8 million units. Even a homebuilding industry at full capacity can only build thousands of new units monthly. Another is affordability: Recent data indicate homes are less affordable now than at any time since 2007.

Methodology

The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis. Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data.

This story was produced by Experian and reviewed and distributed by Stacker Media.