State Farm reveals 20 Central Coast zip codes where policies will be dropped

SANTA BARBARA, Calif. - A recent state filing reveals more than 600 Central Coast State Farm insurance policies will not be renewed due to the company's current financial health.

California's largest homeowner's insurance provider announced back in March that it planned to not renew about 30,000 property insurance and 42,000 commercial property insurance policies adding that renters insurance policies will not be affected.

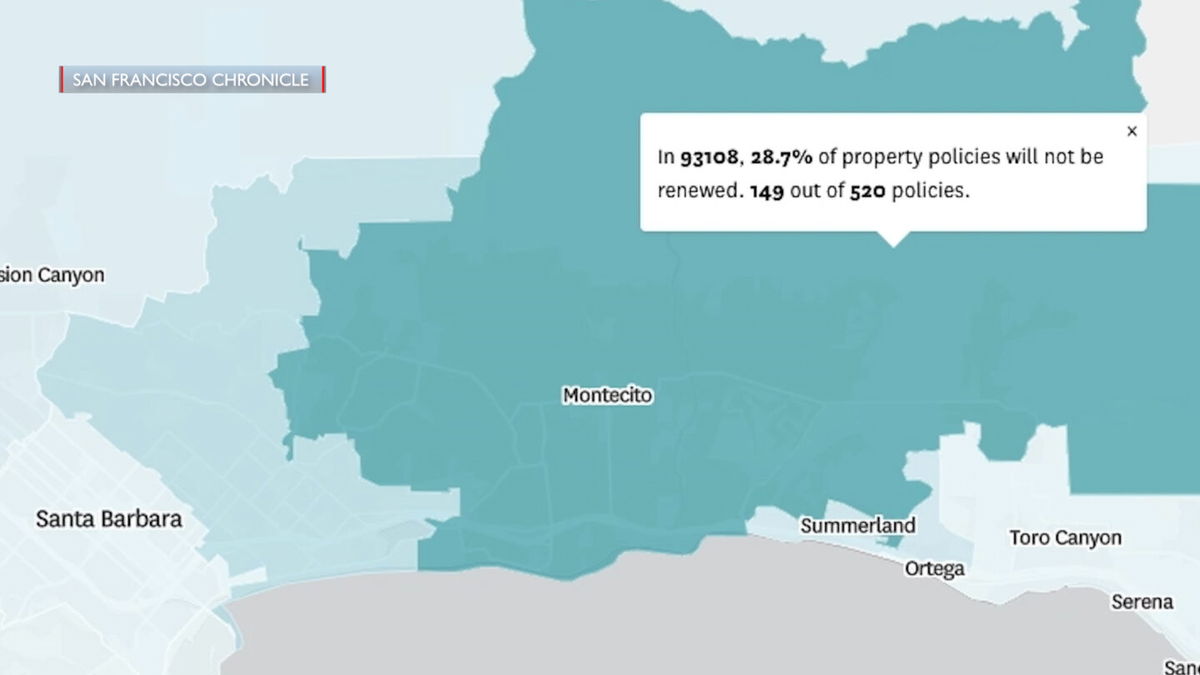

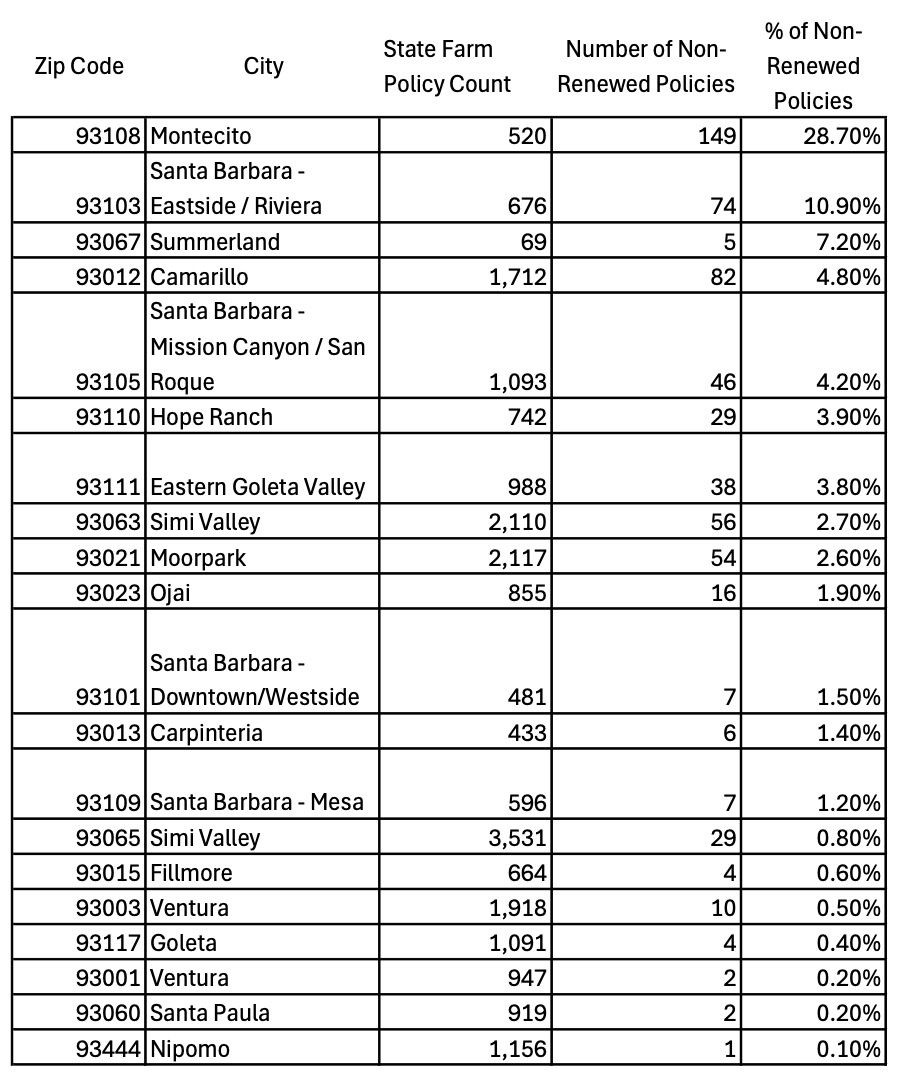

A state filing with the California Department of Insurance shows where those non-renewals will be concentrated.

The City of Orinda, in northern California, tops the list with 55% of the city's more than 3,000 State Farm insurance policies will not be renewed.

On the Central Coast, Montecito tops the list with nearly 30% of the 520 State Farm insurance policies in the 93108 zip code not renewed.

In Santa Barbara, nearly 11% of the 676 State Farm insurance policies in the city's East Side and Riviera area will not be renewed.

In Ventura, nearly 5% of the 1,712 insurance policies in the Camarillo area will not be renewed.

In San Luis Obispo County, only 1 policy in Nipomo will not be renewed according to the document.

The company said those impacted will be notified between July 3 and August 30.

One man on the community networking site Nextdoor posted that he lives in a neighborhood classified as an "extreme fire hazard" by the City of Santa Barbara and recently was notified that his State Farm policy will not be renewed.

"This decision was not made lightly and only after careful analysis of State Farm General's financial health, which continues to be impacted by inflation, catastrophe exposure, reinsurance costs, and the limitation of working within decades-old insurance regulations," said the company in a statement.

The company announced in 2023 that it would stop accepting new business, property, and casualty insurance policies in California starting May 27, 2023. The announcement included that auto policies would not be impacted.

Other insurance companies including Allstate have made similar announcements about not writing new insurance policies in California.

"State Farm General's capital position has severely deteriorated, and we are increasingly concerted about its financial well-being," said Denise Harding, President and Chief Executive Office of State Farm General Insurance Company in a letter to California's Insurance Commissioner Ricardo Lara.

The letter revealed the insurance company had a $1.3 billion policyholder surplus at the end of 2023 compared to a $4.1 billion surplus in 2016.

"Although there haven't been significant wildfire losses for several years, windstorm catastrophes in early 2023 and increasing trends in non-catastrophe water losses and liability claims, without the additional premium needed to support those cost increases, have generated large underwriting losses," explained Harding in the letter.

In February, Commissioner Lara announced proposals to reform the state's insurance regulations.

The new proposal would allow insurance companies to switch from using historical data to catastrophe modeling to calculate projections of future risk when raising rates.

Lara hopes to enact these reforms by December 2024.