How much capital funding do small business owners need? Here's an industry breakdown

Canva

How much capital funding do small business owners need? Here’s an industry breakdown

Small business owners using laptop in restaurant.

The average U.S. business spent $206,383 on capital expenses in 2021, but some types of businesses are more expensive to operate—and more capital-intensive than others.

Whether a business requires brick-and-mortar space, is run online, or consists of providing services is one key factor in determining the amount of capital funding needed. There are many factors that affect capital costs, including direct capital expenses like physical office space, the local real estate market, and equipment. But other factors also indirectly affect capital costs, such as licenses, insurance, professional services like accounting and legal counsel, inventory, number of employees, and marketing needs. When starting a small business, owners need a detailed accounting of their expected capital expenses and startup costs to present to investors and lenders.

Using Census Bureau data, altLINE ranked industries by their average capital expenditures in 2021 and charted the distribution of startup or acquisition capital funding needed in each one. Averages are calculated as total capital expenditures over the total number of business establishments in that industry—not just businesses that used capital funding. The charts showing how many companies in an industry required particular amounts of startup capital expenses are based on 2017 data, which is the latest available with that level of detail, and may show some differences from newer averages based on more recent economic changes.

The distribution charts are based on 2017 data, the latest available in that format, and may show some differences from newer averages based on more recent economic changes.

Keep reading to see the typical capital used to start a business as well as the average yearly cost to run a business in 18 different industries, ranked by average annual capital expenses from lowest to highest.

![]()

altLINE

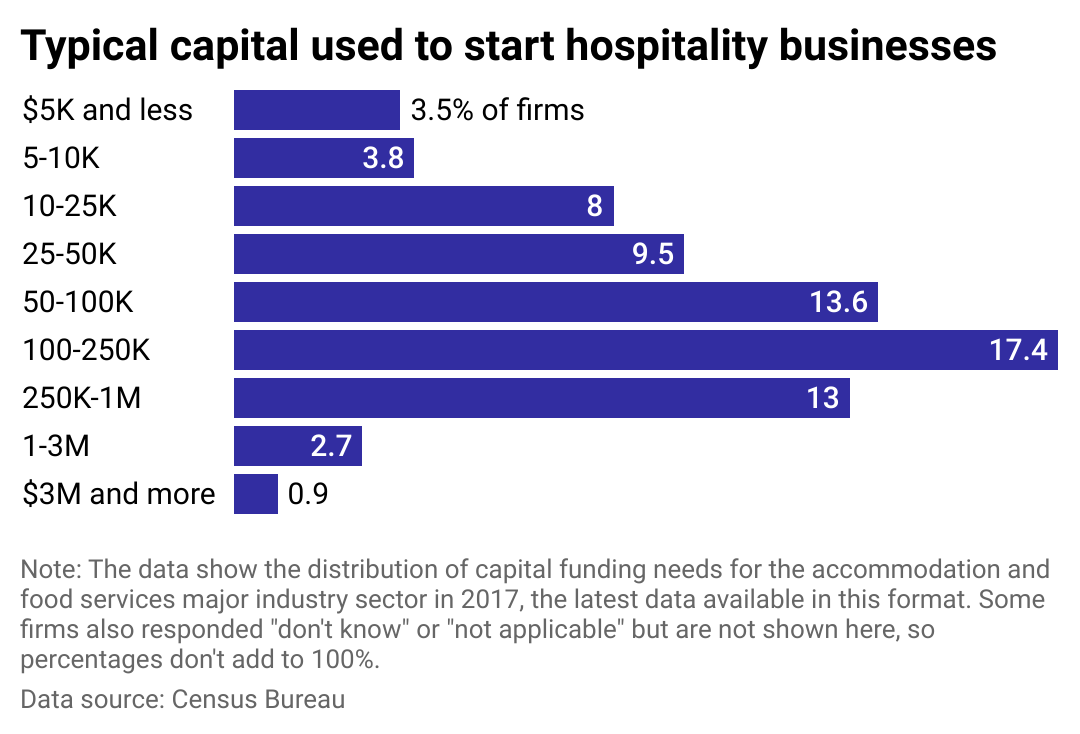

#18. Accommodation and food services

A bar chart showing the distribution of capital funding needs in the accommodation and food services industry.

– Average capital expenditure per establishment, 2021: $41,377

– Total 2021 capital expenditures industrywide: $25.6 billion

The accommodations and food services industry includes hotels and other types of lodging as well as restaurants and bars—all of which require a physical location. The most common range for startup costs in this industry is $100,000 to $250,000, with 17.4% of hospitality businesses reporting their startup costs fell in that range. For hotels, unique capital expenses include real estate—the location will determine the cost as well as the hotel’s ability to attract guests—and room furnishings. The more high-end the accommodations, the more the owner can charge per night.

Restaurants and bars will need to invest in specialty kitchen equipment and possibly a liquor license. The type of cuisine and dining experience can affect capital expenses as well as revenue potential.

altLINE

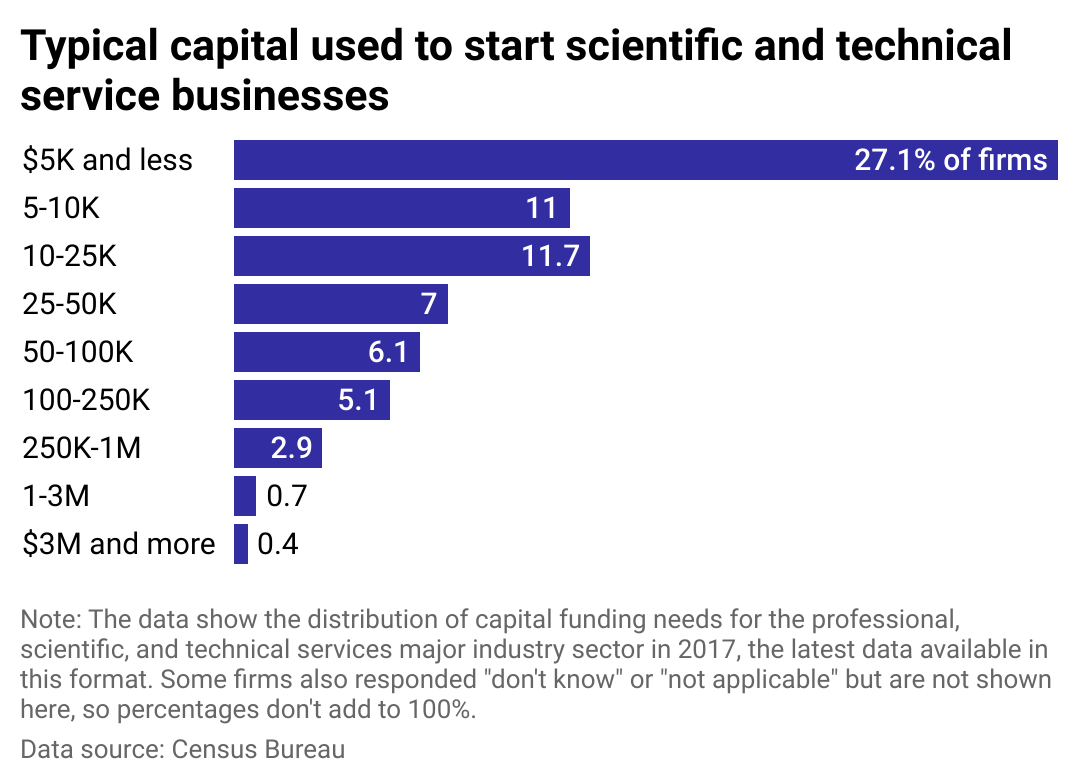

#17. Professional, scientific, and technical services

A bar chart showing the distribution of capital funding needs in the professional, scientific, and technical services industry.

– Average capital expenditure per establishment, 2021: $48,373

– Total 2021 capital expenditures industrywide: $30.9 billion

This is a service provider industry that requires specialized expertise and training. Professionals in this sector can include attorneys, accountants, architects, engineers, computer services, consultants, researchers, photographers, translators, and veterinarians, among others.

More than one-quarter of firms said they launched their business with $5,000 or less in capital funds. These small business owners may offer their services online, perform their services at their clients’ locations, or operate out of a brick-and-mortar location; the type of business will affect capital expenditures. This industry will likely require more investment in professional certifications and licenses. Specialized service providers may be able to operate as a one-person venture or employ a small team, which reduces capital expenditures.

altLINE

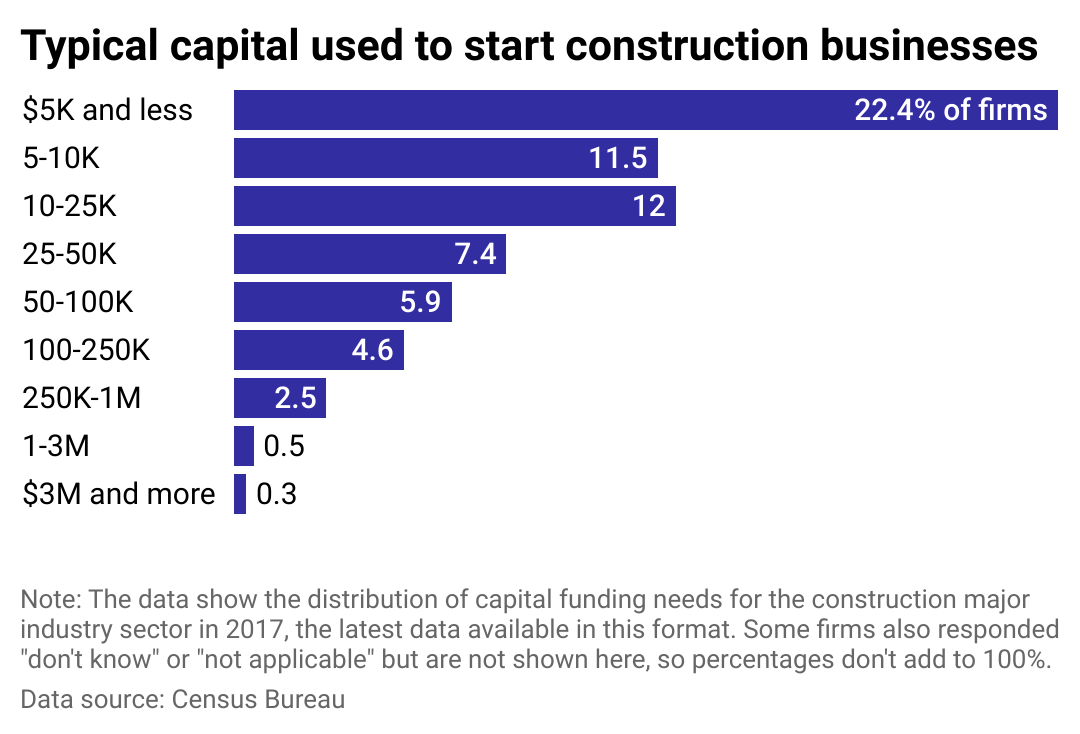

#16. Construction

A bar chart showing the distribution of capital funding needs in the construction industry.

– Average capital expenditure per establishment, 2021: $57,558

– Total 2021 capital expenditures industrywide: $46.6 billion

The construction industry includes small business owners who construct buildings, engineer highways and utilities, and prepare land for new construction. Capital expenditures—which 22.4% of firms said were $5,000 or less—involve purchasing the necessary equipment and securing a place to store it when not in use. Business owners should be prepared for the ongoing capital expense of maintaining company vehicles to transport equipment and workers to job sites. A physical office space may be needed to meet with clients.

altLINE

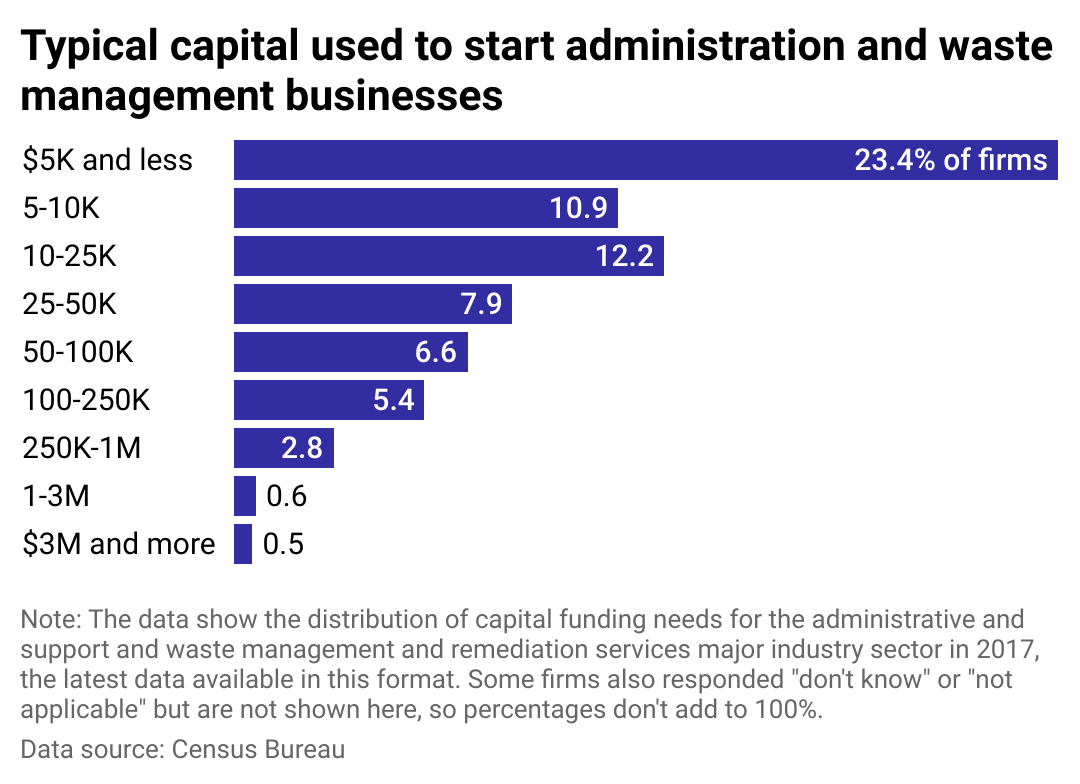

#15. Administrative and support and waste management

A bar chart showing the distribution of capital funding needs in the administrative and support and waste management industry.

– Average capital expenditure per establishment, 2021: $59,720

– Total 2021 capital expenditures industrywide: $44.9 billion

This is a service provider industry that offers routine support for the day-to-day operations of companies and households. Small businesses in this sector may offer office administration, hiring personnel, clerical services, soliciting new business, collecting payments, surveillance, cleaning, and waste disposal. The most common range for startup costs was $5,000 or less, a cost range reported by about 23% of businesses. A brick-and-mortar location will be less important for these businesses because they often provide services at their clients’ locations. But equipment may be expensive.

altLINE

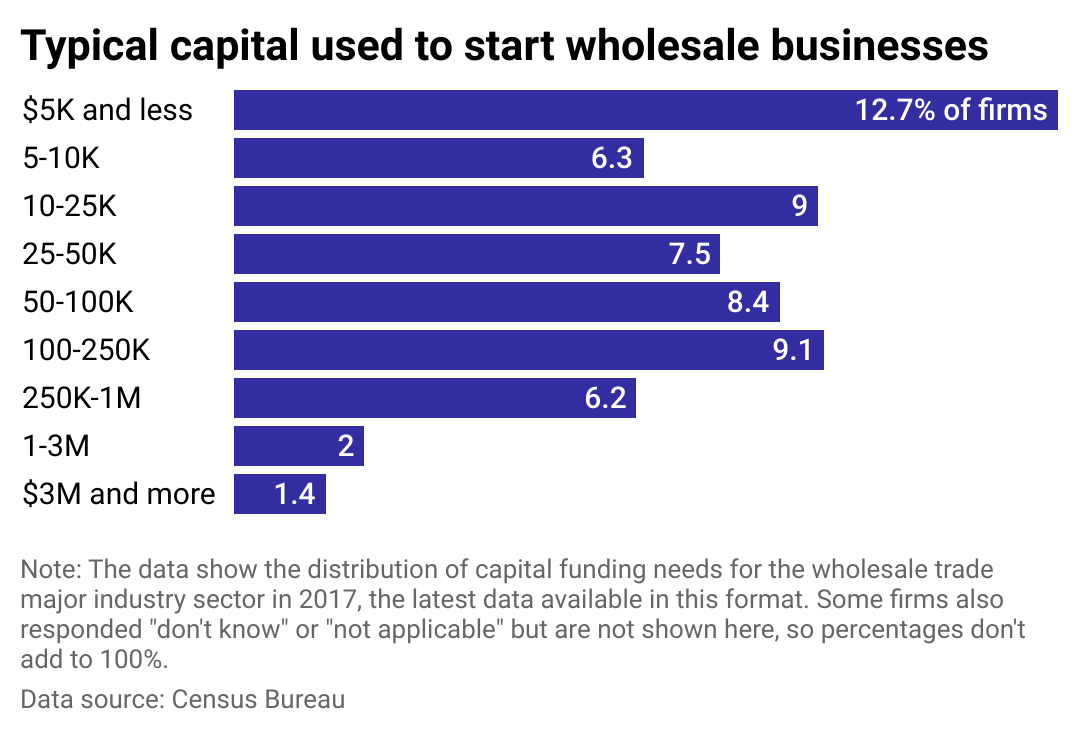

#14. Wholesale trade

A bar chart showing the distribution of capital funding needs in the wholesale trade industry.

– Average capital expenditure per establishment, 2021: $103,469

– Total 2021 capital expenditures industrywide: $26.7 billion

Wholesalers sell merchandise to other businesses, and 12.7% reported they started their business with $5,000 or less. Most of the capital expenses are related to purchasing inventory, maintaining warehouse space to store the merchandise, and having vehicles to transport the merchandise. The type and volume of inventory will determine how much capital funding small business owners need to have on hand. More than a specialized license or training, wholesale trade often depends on the owner’s relationships with buyers—and there’s no way to put a price on that when calculating capital expenses.

altLINE

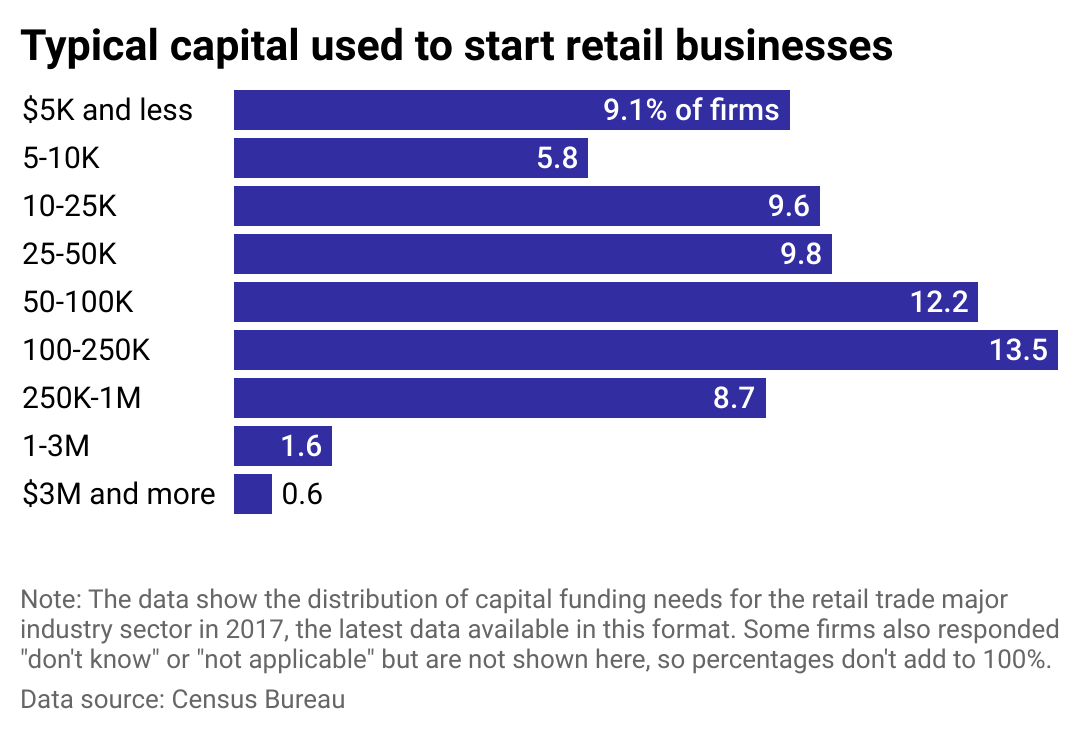

#13. Retail trade

A bar chart showing the distribution of capital funding needs in the retail trade industry.

– Average capital expenditure per establishment, 2021: $116,051

– Total 2021 capital expenditures industrywide: $40.4 billion

Similar to wholesale trade, inventory is one of the main capital expenses in retail. However, more retailers, 13.5%, reported higher startup costs—in the range of $100,000 to $250,000—than wholesale traders. E-commerce and social media advertising have given many small business owners the option to run their retail businesses entirely online, without a physical location. There are trade-offs in terms of capital expenses. Where brick-and-mortar stores will need to consider real estate costs, online-only businesses will need to invest in sophisticated website design with an online sales system, more digital marketing, and shipping.

altLINE

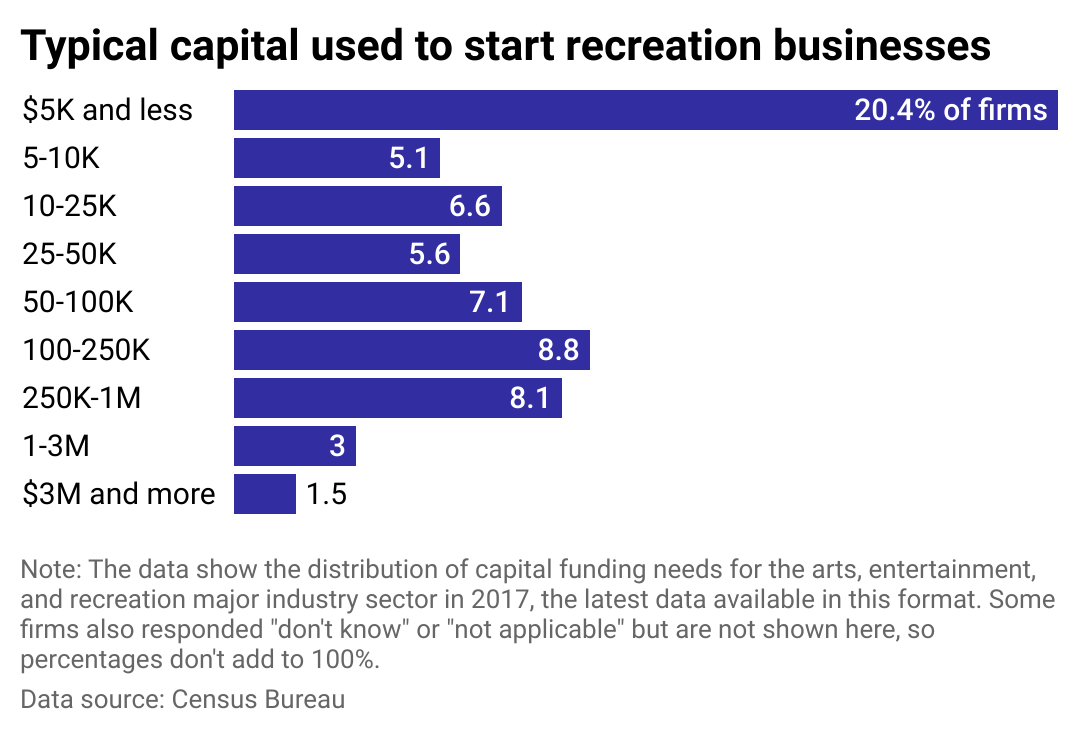

#12. Arts, entertainment, and recreation

A bar chart showing the distribution of capital funding needs in the arts, entertainment, and recreation industry.

– Average capital expenditure per establishment, 2021: $118,454

– Total 2021 capital expenditures industrywide: $120.3 billion

Arts, entertainment, and recreation is a wide-ranging industry that runs the gamut from a freelance graphic designer with relatively low startup and capital expenses to a large amusement park requiring much more significant financial investment. Businesses that produce or promote live performances, events, and exhibits; preserve historically, culturally, or educationally significant objects; or offer recreational, amusement, and leisure activities are all part of this industry.

More than 20% of businesses in this industry report startup costs of $5,000 or less. Small business owners should be prepared for capital expenses related to service equipment, as arts and entertainment success often depends on quality customer experiences. Recreational businesses will have more capital expenses related to specialized equipment needed for certain sports and hobbies.

altLINE

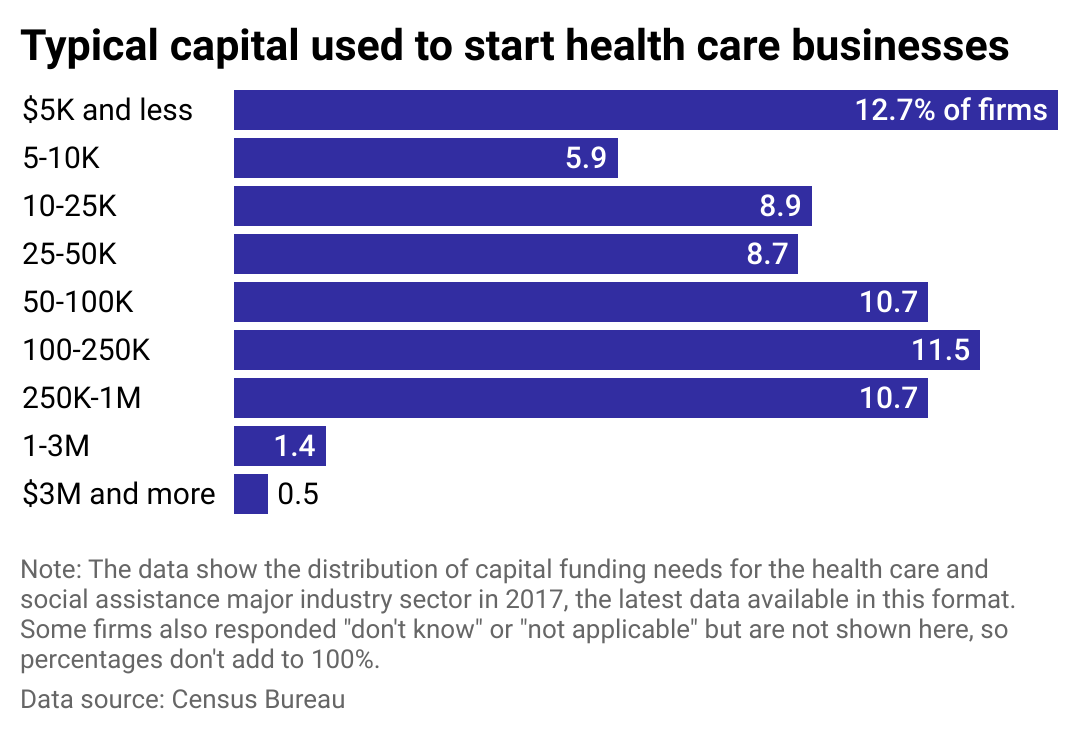

#11. Health care and social assistance

A bar chart showing the distribution of capital funding needs in the health care and social assistance industry.

– Average capital expenditure per establishment, 2021: $120,186

– Total 2021 capital expenditures industrywide: $18.5 billion

The health care and social assistance industry includes various types of medical practitioners and social workers. Many of these businesses will need brick-and-mortar locations such as hospitals and residential care facilities, which is where capital expenses come in—and they may also need specialized equipment as well. Still, the most common range of startup costs is $5,000 or less, as reported by 12.7% of firms in this industry.

altLINE

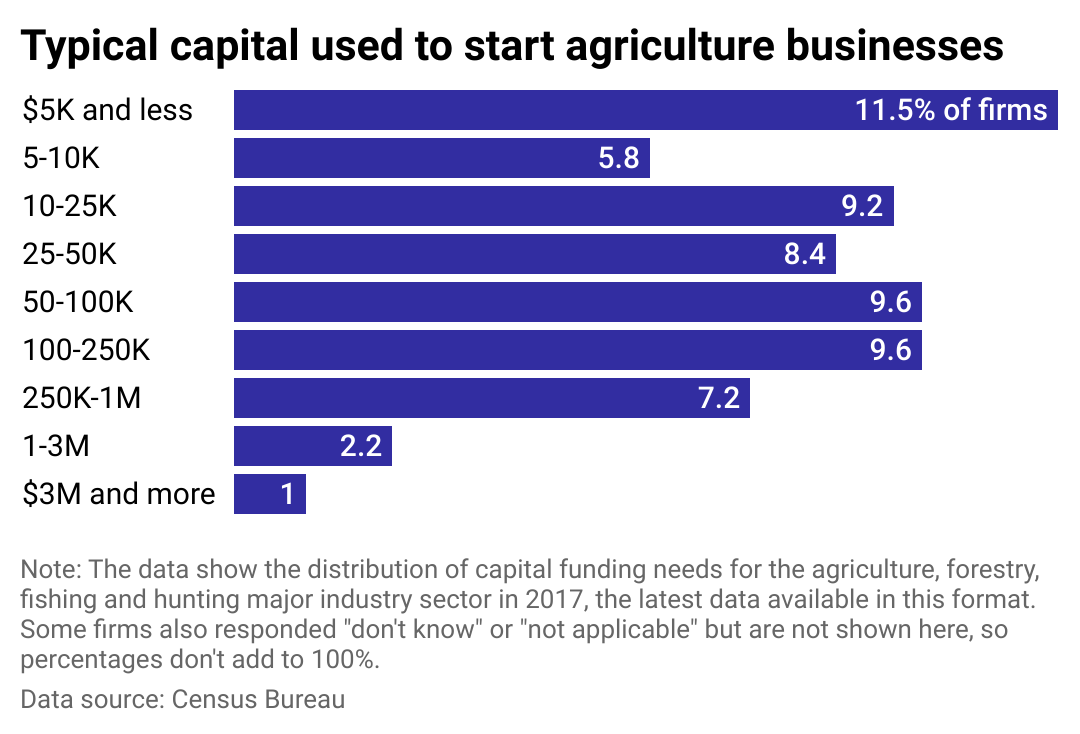

#10. Agriculture, forestry, fishing, and hunting

A bar chart showing the distribution of capital funding needs in the agriculture, forestry, fishing and hunting industry.

– Average capital expenditure per establishment, 2021: $131,371

– Total 2021 capital expenditures industrywide: $113.9 billion

This industry includes farms, ranches, dairies, greenhouses, nurseries, orchards, and hatcheries. Real estate is a high priority, as the plot of land will determine what type of crop or animal can be raised there. Maintaining the business’s physical location will be a significant capital expense, as will purchasing and maintaining specialized farming equipment. Still, it’s most common for this industry to report startup costs of $5,000 or less, as 11.5% of firms did. Part of the reason for this lower financial barrier to entry is that a significant share of farmland is passed down through families and avoids the typical costs associated with large real estate purchases.

altLINE

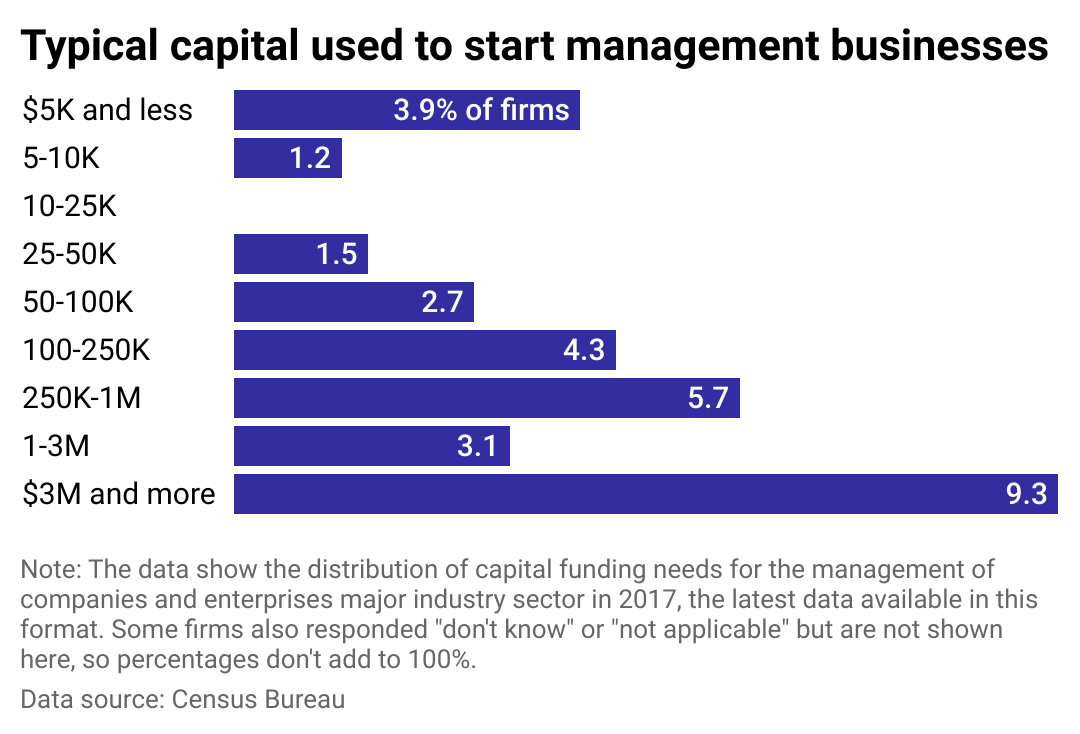

#9. Management of companies and enterprises

A bar chart showing the distribution of capital funding needs in the management of companies and enterprises industry.

– Average capital expenditure per establishment, 2021: $156,476

– Total 2021 capital expenditures industrywide: $3.1 billion

Businesses in this industry inform management decisions and handle strategic and organizational planning and decision-making. These service providers are typically hired when companies scale up. Startup costs are often high, with 9.3% of businesses in this industry reporting they spent $3 million or more to launch. Small business owners in this space are more likely to need people—specialized professionals like accountants, bookkeepers, and financial managers—than an office or other capital equipment.

altLINE

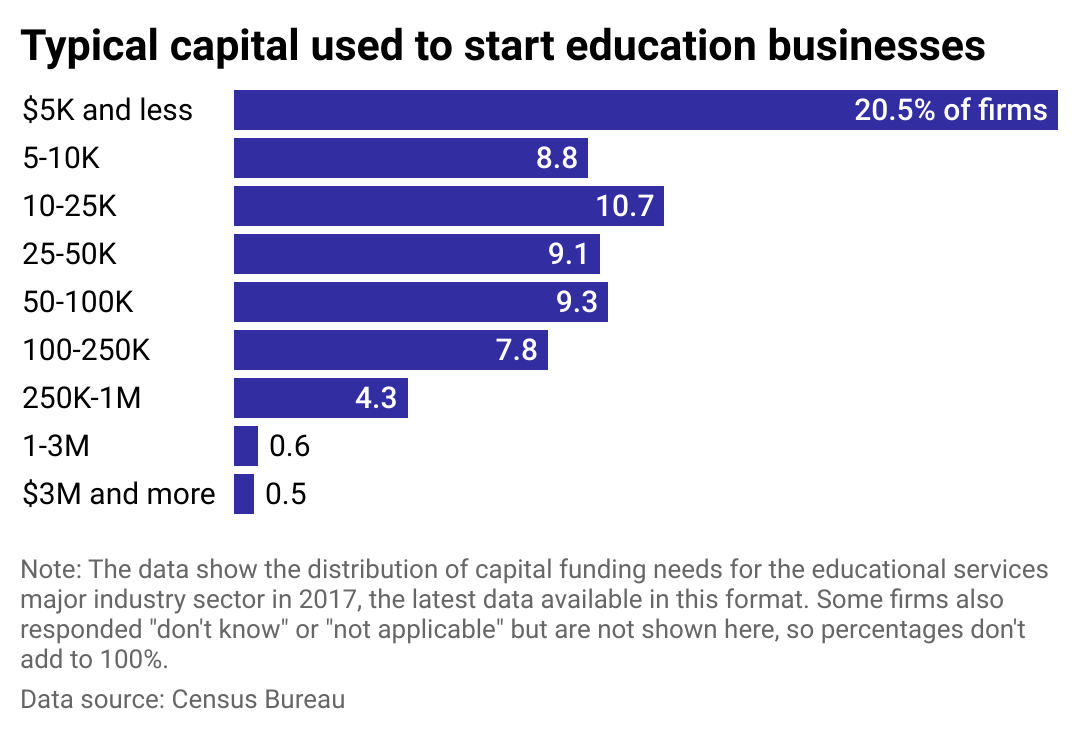

#8. Educational services

A bar chart showing the distribution of capital funding needs in the educational services industry.

– Average capital expenditure per establishment, 2021: $258,412

– Total 2021 capital expenditures industrywide: $8.1 billion

Educational services is the first industry in this ranking where average annual capital expenditures exceed the national average for all businesses of $206,383. Schools, colleges, universities, and training centers fall into this category. One-fifth of education businesses report relatively low startup costs of $5,000 or less, which may reflect new online learning opportunities. Schools with a physical location will need to invest in real estate and building maintenance. Education businesses also have significant noncapital expenses, as educators must obtain specialized credentials.

altLINE

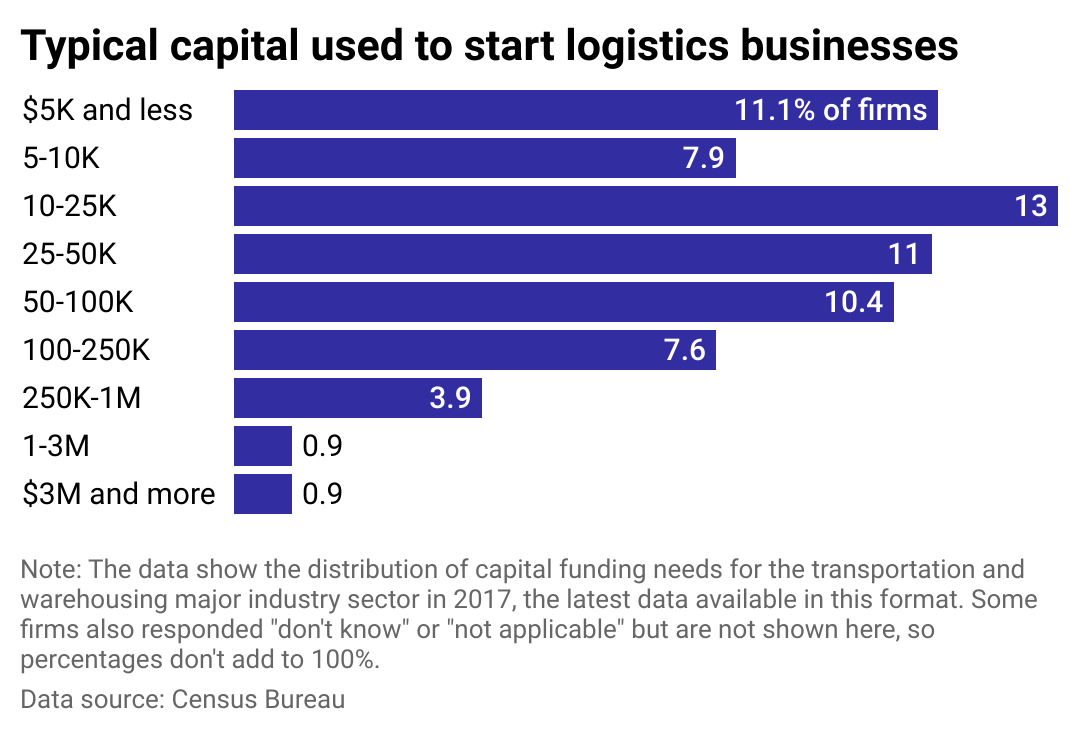

#7. Transportation and warehousing

A bar chart showing the distribution of capital funding needs in the transportation and warehousing industry.

– Average capital expenditure per establishment, 2021: $335,761

– Total 2021 capital expenditures industrywide: $28.8 billion

This industry includes businesses that transport people and cargo, warehouse and store goods, and provide transportation for sightseeing. For transportation companies, a significant capital expense will be purchasing and maintaining a vehicle fleet, whether that’s trucks, cars, planes, boats, trains, or pipelines. Warehouse businesses will need physical space to store goods. Thirteen percent of businesses in transportation and warehousing said their startup costs were between $10,000 and $25,000.

altLINE

#6. Real estate and rental and leasing

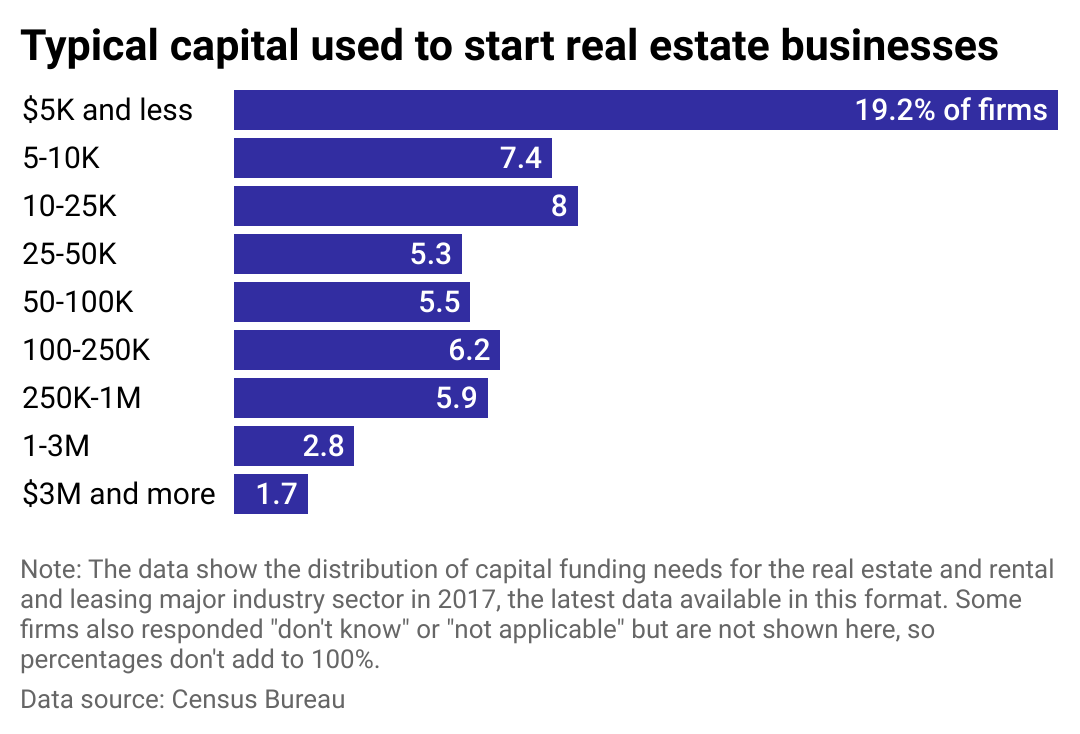

A bar chart showing the distribution of capital funding needs in the real estate and rental and leasing industry.

– Average capital expenditure per establishment, 2021: $347,041

– Total 2021 capital expenditures industrywide: $93.7 billion

This industry includes professionals who help people buy and rent real estate; businesses that lease vehicles, equipment, and other tangible assets; businesses that lease intangible assets like patents and trademarks; and real estate management companies. Small business owners running a real estate company may have a brick-and-mortar location or connect with clients online, which creates a range of capital funding needs.

Businesses leasing vehicles or equipment should plan on capital expenses related to assembling a fleet of vehicles and carrying insurance that covers the lessees. Businesses leasing intangible assets will likely have lower capital funding needs. Most commonly—for 19.2% of firms in this industry—startup costs are $5,000 or less.

altLINE

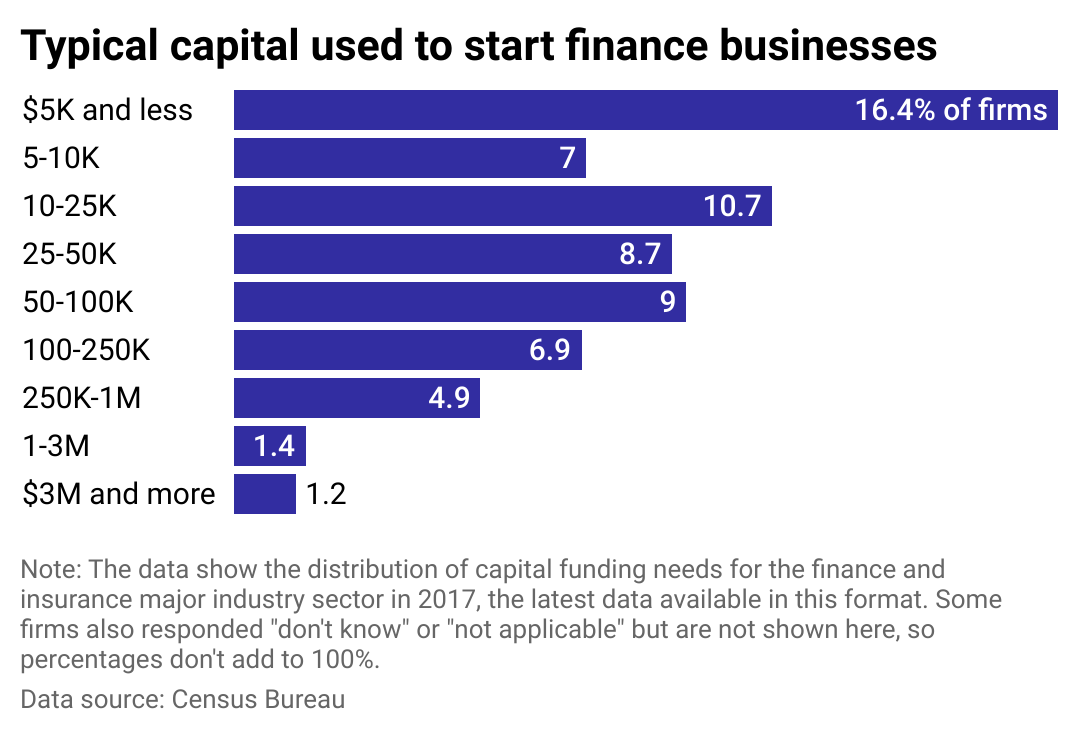

#5. Finance and insurance

A bar chart showing the distribution of capital funding needs in the finance and insurance industry.

– Average capital expenditure per establishment, 2021: $363,968

– Total 2021 capital expenditures industrywide: $158.3 billion

Finance and insurance businesses are involved in making loans, purchasing securities, taking deposits, underwriting insurance policies and collecting fees, and providing specialized services related to employee benefits and related financial and insurance needs. Among the financial and insurance businesses, 16.4% of firms say their startup costs were $5,000 and less. Capital funding needs in this industry likely include maintaining a physical location to meet with clients and conduct business.

altLINE

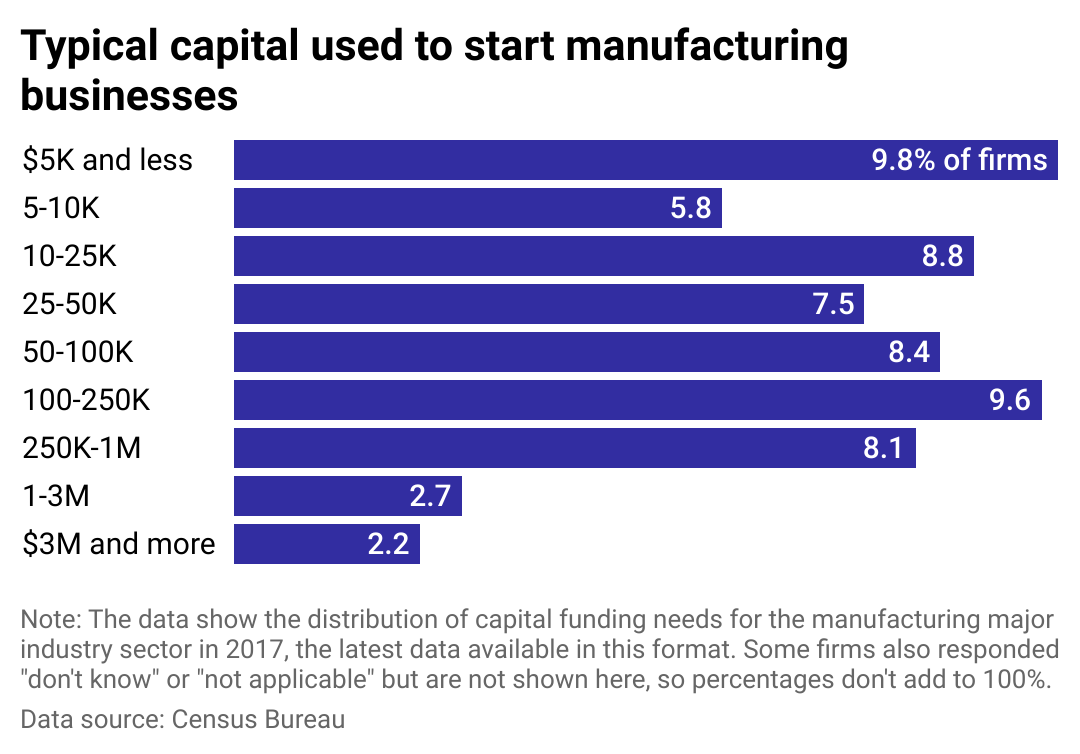

#4. Manufacturing

A bar chart showing the distribution of capital funding needs in the manufacturing industry.

– Average capital expenditure per establishment, 2021: $997,032

– Total 2021 capital expenditures industrywide: $174.3 billion

The manufacturing industry includes any business that transforms materials, substances, or components into new products. This consists of businesses typically associated with manufacturing like plants, mills, and factories as well as bakeries, candy stores, and custom tailors.

The amount of capital funding required to run these types of businesses varies depending on the materials used, the sophistication of the manufacturing process, and the types of machinery required. Nearly 10% of businesses in this industry had startup costs in the range of $100,000 to $250,000 while another nearly 10% had startup costs of $5,000 or less. Whatever the type of business, manufacturers will likely need to invest in a physical location for their business.

altLINE

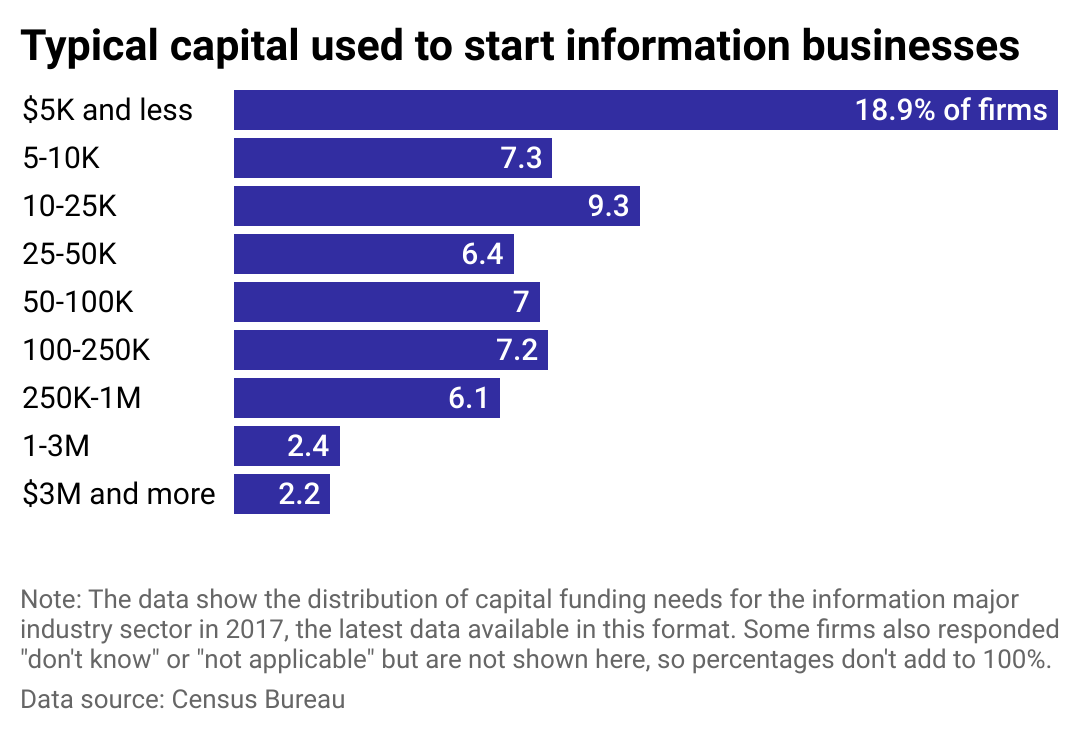

#3. Information

A bar chart showing the distribution of capital funding needs in the information industry.

– Average capital expenditure per establishment, 2021: $1,200,277

– Total 2021 capital expenditures industrywide: $282.2 billion

The information industry includes software publishing, entities that publish information online, movie production, sound recording, broadcasting, telecommunication, web search portals, data processing, and information services. Much of this work can be done online, so small business owners may not need to spend capital funding on opening a physical location. Significant capital expenses in this industry include building out a communications infrastructure, software licensing, and data security systems. The most common range of startup costs for information firms was $5,000 or less, which was reported by nearly 19% of firms.

altLINE

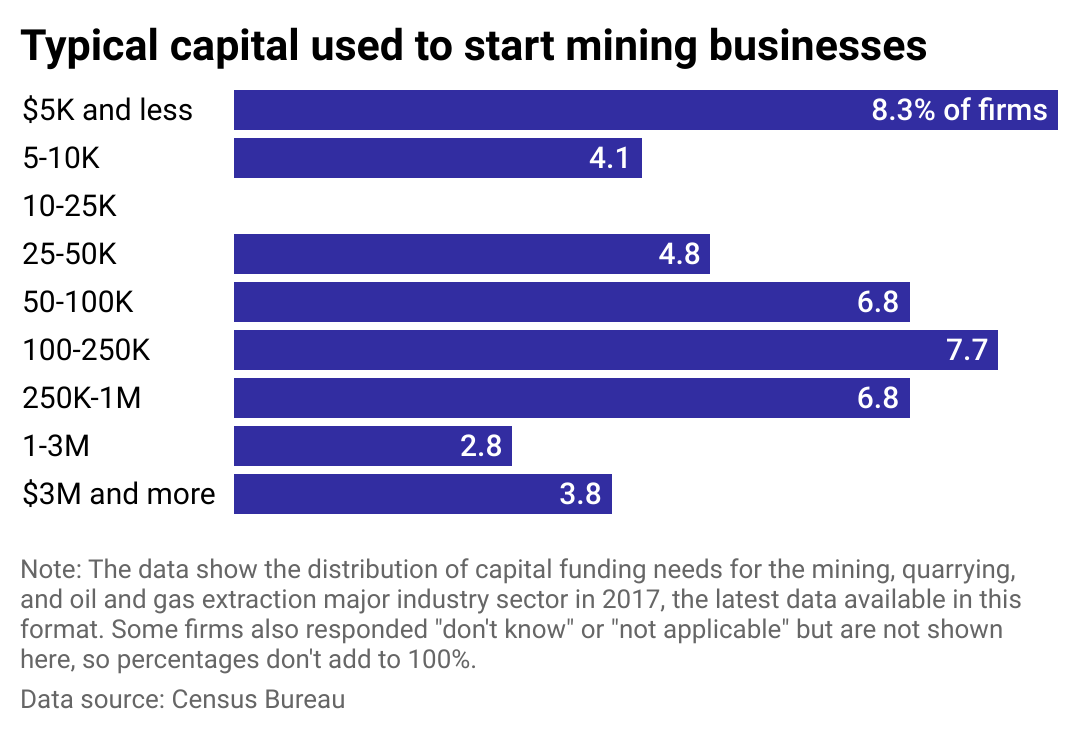

#2. Mining

A bar chart showing the distribution of capital funding needs in the mining industry.

– Average capital expenditure per establishment, 2021: $3,954,703

– Total 2021 capital expenditures industrywide: $194.5 billion

Mining refers to businesses that extract, quarry, and treat minerals and energy sources including coal, gas, and oil. Similar to the agricultural industry, the physical location of these businesses is a top priority as the plot of land will determine how much of a given substance is available for mining. Real estate and specialized equipment are significant capital expenses. Just over 8% of mining businesses launched with $5,000 and less, while another 7.7% spent $100,000 to $250,000 on startup costs. Mining is a risky venture given the high annual capital expenditures combined with the volatile pricing of metals and other mined substances.

altLINE

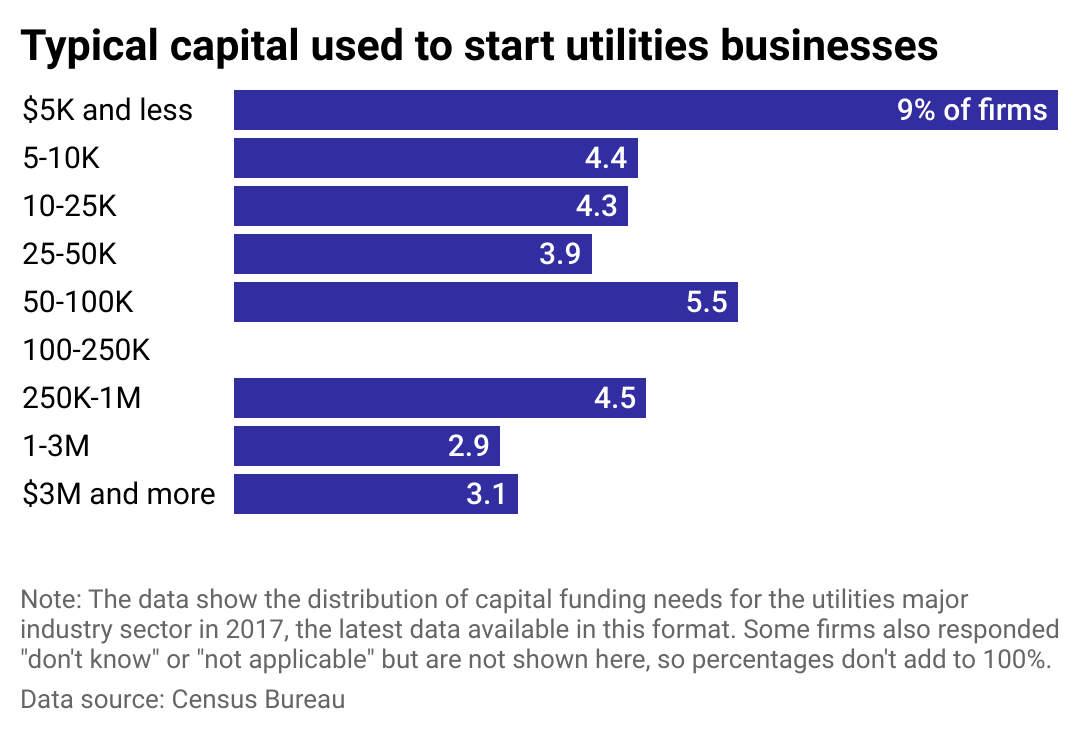

#1. Utilities

A bar chart showing the distribution of capital funding needs in the utilities industry.

– Average capital expenditure per establishment, 2021: $8,934,359

– Total 2021 capital expenditures industrywide: $91.1 billion

Utilities have the highest annual average capital expenses. This industry includes companies that provide electrical power, natural gas, steam, water, and sewage removal. Sizable capital expenses are related to the technology and equipment needed to generate the utility and the complex infrastructure needed to deliver it to consumers. In addition, these businesses also need licenses, insurance, and skilled employees to do this work. Capital spending is expected to increase in the coming years as utility companies shift to cleaner energy production.

Data reporting by Paxtyn Merten. Story editing by Jeff Inglis. Copy editing by Tim Bruns.

This story originally appeared on altLINE and was produced and

distributed in partnership with Stacker Studio.